At Launchways, we’re constantly looking for new innovative,

effective ways to help businesses meet their HR, employee benefits, and

business insurance needs. This month, we’re proud to announce we are adding Group

Insurance Captive solutions to our ever-expanding portfolio of solutions for

growing businesses.

In this post we’ll:

- Define Group Insurance Captives in a

straightforward and useful way

- Explain the value proposition of our group

captive membership

- Describe why we’re so excited to be offering

this new program

- Provide next steps for businesses hoping to

learn more about our group insurance captive

What is a Group Insurance Captive?

A “captive” insurance company is an organization founded

with the sole purpose of providing business insurance to its owner(s).

Essentially, a captive is the purest form of self-insurance.

A business or group of businesses forms a captive in order to meet their

insurance needs without being beholden to the packages, limitations, and pricey

markups of the traditional marketplace.

A group insurance captive specifically involves a group or

“pool” of businesses with similar scales or goals coming together to create and

share a captive insurance company. That new company, managed by a designated

third party, obtains insurance for each owner/member organization, processes

their claims, and maintains the overall health of the pool.

How Do Businesses Benefit from Joining Our Group Insurance Captive?

So, now that you know what a group insurance captive is, the

natural question is: Why would you want to be part of one?

Organizations that form or participate in a group captive

have greater independence, greater power for self-determination, and greater

potential for profit. Let’s take a look at some of the specific ways those

gains play out:

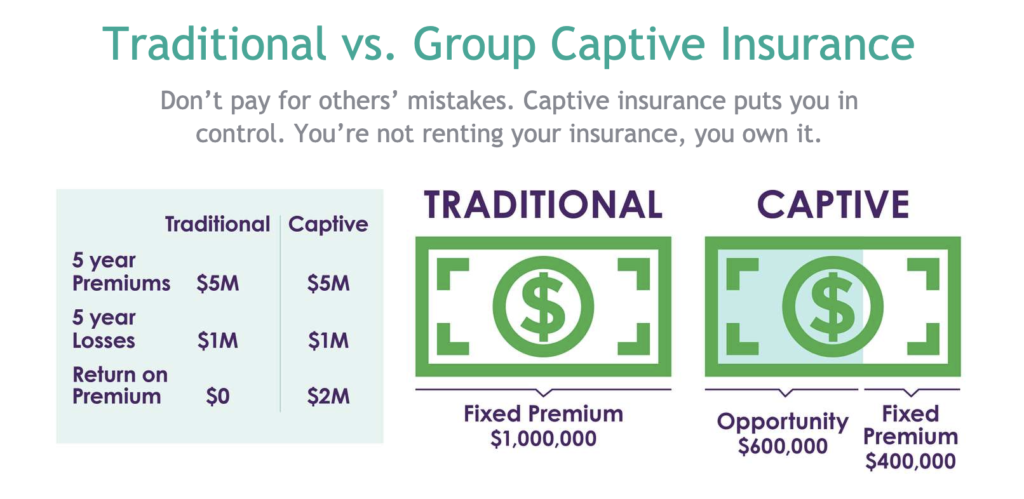

- In the traditional marketplace, you rent

your insurance. With a captive you own it.- Total continuity of services as desired

- No stress over price-gouging at policy renewal

- In the traditional marketplace, business

insurance is an expense; in a captive, it’s an opportunity

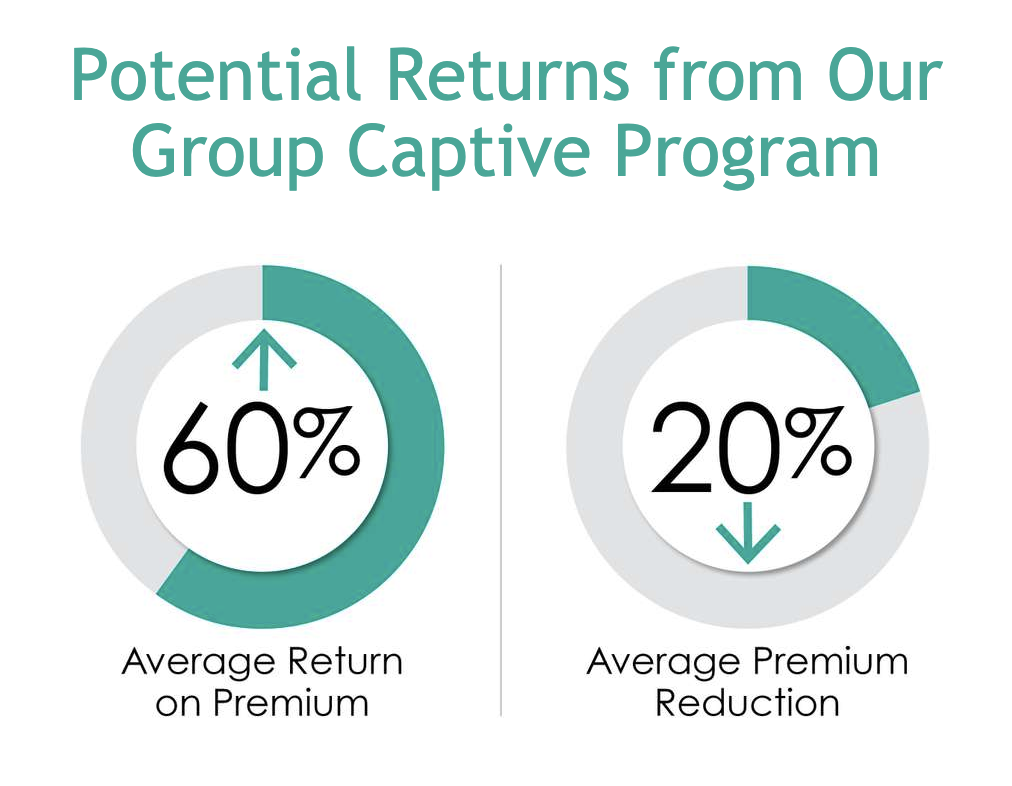

for return.- Get up to 60% average return on premium

- Use safety initiatives/risk management skills to

maximize your payout

- With your own insurance company, you can get exactly

the coverage you need and eliminate overspend.- No more bundled services you don’t want or need

- Turn self-knowledge into efficiency-of-scale

- Owning your insurance company means you

call the shots!- Work with your pool partners to set the tone for

the captive

- No more getting sold out or let down by the

insurance company

- Work with your pool partners to set the tone for

- With a captive, you have greater access to

insurance data than ever before.- Understand your needs, claims, and expenses

better than ever

- Gain insights to help streamline coverage/claims

processing in the future

- Understand your needs, claims, and expenses

How to Know if You’re a Good Fit for Our Group Insurance Captive:

Once you hear about the potential benefits of group

insurance captives, it’s natural to wonder if your organization is a fit to

join.

If your business can answer “YES!” to each of the following

questions, then you’re a great candidate for our new group insurance captive

program:

- Do you pay $150,000 or more in insurance premiums each year?

- Does your company have an entrepreneurial spirit?

- Does your company desire greater control and stability?

- Does your company understand the concept of “risk for reward?”

- Is your company committed to safety?

Why Join a Launchways Group Insurance Captive in 2020?

Now that you’ve got a general understanding of what group

insurance captives are and what kind of value they offer businesses, it’s time

for us to answer another important question: Why us?

Since our inception, Launchways has focused on providing

support and solutions that help growing businesses thrive in the immediate

future while also planning for long-term success.

We’re entering the world of Group Insurance Captives because

we understand that business insurance needs are increasingly diverse, and more

and more organizations are feeling frustrated by the limitations of the

traditional marketplace. We want to help our clients bet on themselves, forge

powerful partnerships with likeminded businesses, and get the exact coverage

they need to thrive.

We believe in the power of growing organizations to improve

the business space and lead the next wave of American innovation. That’s why

we’re helping businesses find potential pool partners, organizing our group

insurance captive, and connecting organizations with the management and

expertise they require to ensure their captive experience is successful.

Takeaways:

Here at Launchways, we’re excited to be helping our clients

gain the power and freedom group insurance captive membership can bring. We’re

looking forward to applying our innovative approach and emphasis on specific

customer goals to help businesses gain the power, efficiency, and profit

potential our group captive offers.

Remember:

- Group insurance captives offer businesses true

ownership over their insurance, enabling:- New profits from return on premiums

- Increased control over claims management

- Innovative partnerships with pool peers

- To be a strong group captive candidate, a

business should pay at least $150,000 in annual insurance premiums and be a

stable but innovative organization

How to Learn More:

Are you interested in learning more about our captive program and if your business qualifies? Request a free consultation with our business insurance experts.